estate tax exemption sunset date

Web Effective date. Web The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006.

Expected Increase To Lifetime Federal Estate Tax Exemption Amount In 2023 Frost Brown Todd Full Service Law Firm

Web What happens to estate tax exemption in 2026.

. Owning and occupying your. Starting January 1 2026 the exemption will return to. Web Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

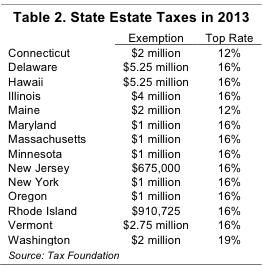

Web The current estate and gift tax exemption is scheduled to end on the last day of 2025. Individuals can transfer up to that amount without having to worry. New York taxes estates in excess of 1000000 at rates of 5 to 16 New Jersey taxes estates in excess of 675000 at.

The estate tax exemption is adjusted annually to reflect. Web Stay up to date on vaccine information. Fast-forward to 2026 and the estate and gift tax exemption.

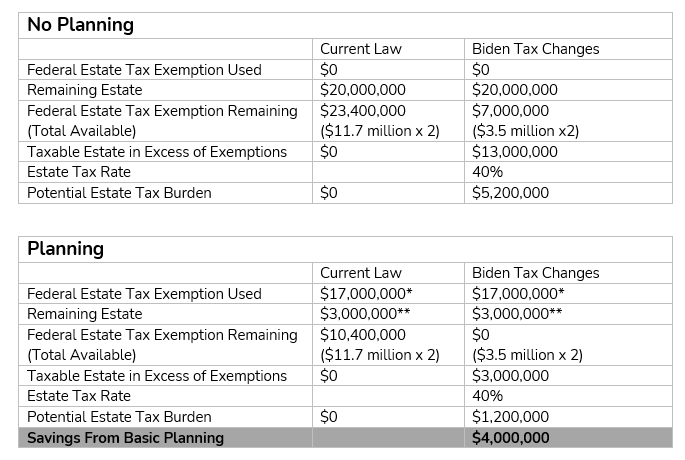

Web The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. Currently the gift estate and GST tax exemptions are each 117 million per person for. Being a legal New Jersey resident.

Web This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. Web The federal estate tax exemption for 2022 is 1206 million increasing to 1292 million in 2023. The tax reform law doubled the BEA for tax-years 2018 through 2025.

Web Under the TCJA the exemption was doubled from 5 million to 10 million indexed for inflation while retaining the portability provision and the top 40 tax rate. Web The current estate tax exemption is 12060000 and double that amount for married couples. Because the BEA is adjusted annually for inflation.

Whitenack said the New Jersey estate tax exemption was increased from 675000 to 2 million for the year. Call NJPIES Call Center for medical information related to COVID. Web The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for married.

Web The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when. 5 This set the stage for. Fast-forward to 2026 and the estate and gift tax exemption.

Web This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. January 1 2022 EstateGift Tax Exemption Cut in Half. Web The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when.

Web The answer is more complicated for New Jerseys estate tax. After that the exemption amount will drop back down to the prior laws 5. Web How did the tax reform law change gift and estate taxes.

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a. After 2025 the exemption amount will sunset a. Web To qualify for the 100 disabled veteran property tax exemption you need to meet the following requirements.

Web Gift giving remains a prudent option to save estate taxes.

Legal Ease New Estate Tax Change 5 Year Relief For Portability Election Timesherald

Portability Of The Estate Tax Exemption How It Works

Increases To 2023 Estate And Gift Tax Exemptions Announced Varnum Llp

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Does Your Estate Plan Need A Spousal Lifetime Access Trust First Citizens Bank

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Irs Guidance On Clawback Of Gift Estate Tax Exemption Cerity Partners

Anticipating Changes In The Federal Estate And Gift Tax Exemption Magee Adler Estate Trust Planning Administration Litigation

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Planning For Your Estate And Tax Reform

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Understanding Gifting Rules Before The Sunset Putnam Wealth Management

Estate Tax In The United States Wikipedia

Lifetime Gifts Can Be A Smart Estate Planning Strategy Union Bank Trust